Audit Procedures for Cash and Cash Equivalents

Unverified transfers of cash or cash equivalents are prohibited. The second is Cash Equivalents which are investments that are short-term highly liquid and are readily convertible to.

Overview When auditors begin the audit planning phase it is important for them to consider the fact that there are several different phases that are included in order to properly execute the auditing process.

. 41510 Pursuant to RCW 4309230 Annual Reports are to be certified and filed with the State Auditors Office SAO within 150 days after the close of each fiscal year. Audit Procedures for Cash Bank Confirmation. An audit report is an independent opinion of a personfirm ie.

The decision was based on the councils being regulated by the Water Management Act when operating as a water supply authority. All cash and bank audit procedures need to be properly documented and all. Cash and Cash Equivalent is scoped under IAS 7 Statements of Cash Flows.

As noted in Table 2 the system had approximately 114 million in cash and cash equivalents in local bank accounts and approximately 793 million in the state treasury at June 30 2012. Has audited Income Statement Balance Sheet Cash Flow Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. The first is cash which comprises cash on hand and at the bank.

Cash and cash equivalents it is the most liquid asset which includes currency deposit accounts and negotiable instruments eg money orders cheque bank drafts. Ebook ou e-book aussi connu sous les noms de livre électronique et de livrel est un livre édité et diffusé en version numérique disponible sous la forme de fichiers qui peuvent être téléchargés et stockés pour être lus sur un écran 1 2 ordinateur personnel téléphone portable liseuse tablette tactile sur une plage braille un. Auditing cash tends to be straightforward.

Federal government websites often end in gov or mil. They will need to get idea about the number of banks types of bank accounts authorized signatories authorization matrix bank payment process petty cash payment process etc. Auditing Interest Expenses Risks Assertions And.

This will help the auditor to plan audit procedures for cash and cash equivalents. 41 Reporting Principles and Requirements. 05 DARRELL JOE O.

In the audit of cash bank confirmation is the process to ask for verification or confirmation to the third party which is the bank on the cash accounts and balances that the company has at the. Liquid funds are considered as cash equivalents by the exchange so the above 50 rule wouldnt apply. The application of audit procedures to less than 100 percent of the items within a population to obtain audit evidence about a particular characteristic of the population.

These procedures must include documentation by shift session or. Cash Flow to Assets Used to measure the ability of ASSETS to generate operating CASH FLOWS. ASUNCION CPA MBA DEFINITION OF CASH Cash includes money and other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit.

1 Substantive Analytical Procedures. 415 Reporting Requirements and Filing Instructions for Cities and Counties. Substantive Analytical Procedures analyze the changes or lack of changes in the entitys financials performance.

The recorded balances reflect the true underlying economic value of the cash and cash equivalents. Cash and Cash Equivalents for Year Ended June 30 In Thousands Carrying Amount 2012 2011 2010 Cash in bank 56362 60809 46487. Recall the Parmalat and ZZZZ Best Carpet Cleaning frauds.

In those businesses the theft of cash was covered up. Audit subject matter risk. But are such procedures always adequate.

All delayed payment interest charges accumulated will be debited once every month on the. In Cash and Cash Equivalents there are two separate components. Or the statement which shows the total cash inflow and outflow of an Organization is termed as cash flow statement.

Substantive Audit Procedures for Cash Receipts consist of the following components. A cash base statement that shows the changes in the balance sheet and Income statement that affect cash cash equivalents. Cash and paper money US Treasury bills undeposited receipts.

41520 The following matrix provides additional. The changes or lack of changes must be benchmarked against a set expectation. - Business risk customer capability to pay credit worthiness market factors etc.

Substantive Audit Procedures for Cash Receipts. This is a statement of the companys cash and cash equivalents Cash And Cash Equivalents Cash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Performance-based cash assistance is provided to each State agency for lunches served in accordance with 2107d.

Short-term investments include securities bought and held for sale in the near future to generate income on short-term price differences trading securities. Cash Flow to Sales. To audit Cash and Cash equivalents you will need to get a clear idea about the bank accounts types of bank accounts number of bank accounts purpose of each bank account banking.

We usually just obtain the bank reconciliations and test them. 1 Page 1 of 17 AUD Handouts No. It proves to be a prerequisite for analyzing the business.

Assets and liabilities for which the turnover is quick and the maturities are three months or less such as debt loans receivable and the purchase and sale of highly liquid investments Cash Flows from Operating Activities. Cash purchases and sales of cash and cash equivalents. 3 Cash Flow Statement.

The former councils final financial statements for the period ended 12 May 2016 disclosed these amounts as unrestricted cash cash equivalents and investments in the relevant note disclosures. Controlling cash receipts and cash disbursements reduces erroneous payments theft and fraud. Here we discuss Types of Audit report opinion and Sample Audit Report examples including Facebook Tesco Plc.

It includes cash on hand demand deposits and other items that are unrestricted for use in the current operations. All cash equivalent stocks are updated here. Therefore it is important for auditors to ensure that they are able to factor in all the elements within the financial.

Distribution of a CORPORATIONs earnings to stockholders in the form of CASH. Risk relevant to the area under review. The Margin received from pledging liquid funds will be as good as having cash in your trading account.

Before sharing sensitive information make sure youre on a federal government site. Le livre numérique en anglais. Special cash assistance is provided to each State agency for lunches served under the National School Lunch Program to children determined eligible for free or reduced price lunches in accordance with part 245 of this chapter.

Internal control includes corporate governance company policies segregation of duties authorized approvals for purchases designated signature authority with limits payments reconciliation and bank. 2 Procedures must be implemented to control cash or cash equivalents based on the amount of the transaction. The gov means its official.

Cash Equivalents Short-term generally less than three months highly liquid INVESTMENTS that are convertible to known amounts of cash. Auditor about whether the financial statements present a true fair view of the state of affairs of the entity profitloss of the entity cash flows for the year and such opinion is given after performing reasonable audit procedures so obtain sufficient appropriate evidence for the assurance. We send confirmations and vouch the outstanding reconciling items to the subsequent months bank statement.

Auditing Cash and Cash. Cash control is cash management and internal control over cash.

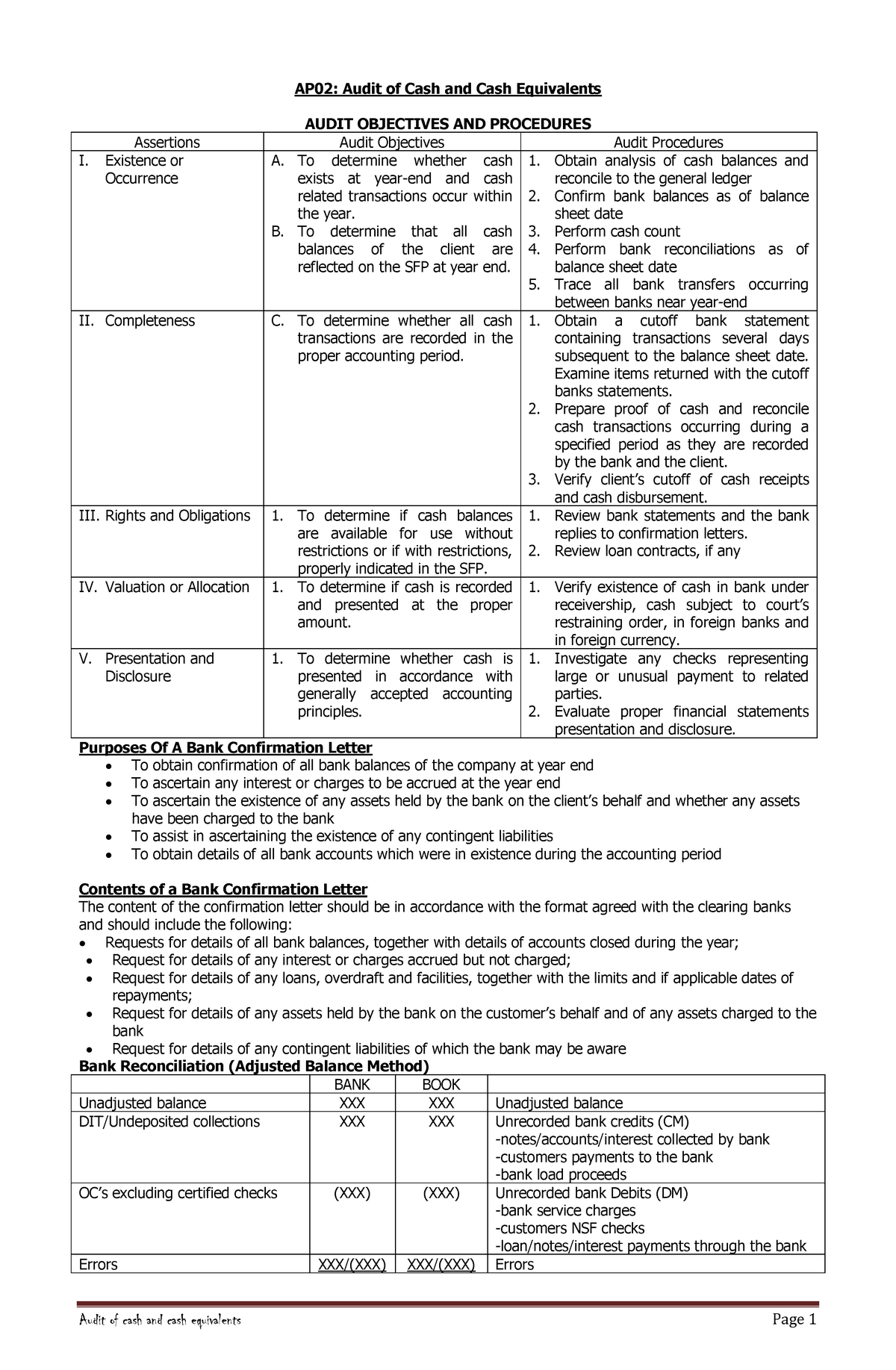

Audit Of Cash And Cash Equivalents Existence Or Occurrence A To Determine Whether Cash Exists At Studocu

No comments for "Audit Procedures for Cash and Cash Equivalents"

Post a Comment